- Money Menu

- Posts

- Menu #9: Elevating your credit score for financial success

Menu #9: Elevating your credit score for financial success

PLUS: Digital bites we think you’ll like

Read Time = 4 mins

Good Morning, Money Menu readers! A warm welcome to new subscribers this week. Think of us as your new PFF (personal finance friends) 🤝

On last week’s menu, here’s what you missed in the previous menu.

On today’s menu, we’re discussing how to improve your credit score.

On next week’s menu, we’ll dive into what to do with your tax refund.

STATS STACK 🥞

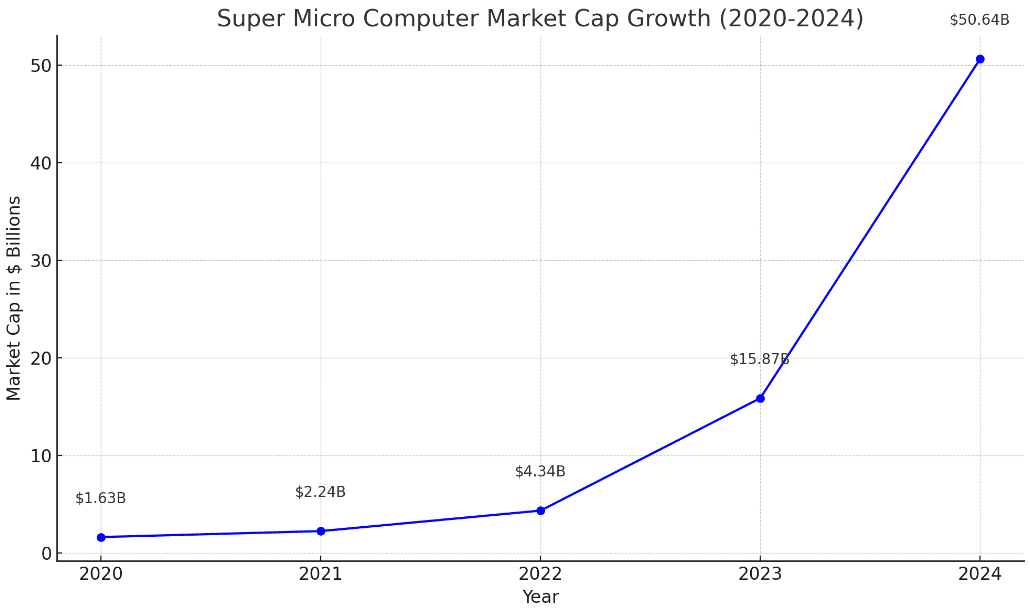

1 new company Super Micro is joining the S&P 500 following a historic rally in the stock that has pushed the company’s market cap past $50 billion (Source: CNBC).

$150 million is the projected total of India’s most lavish wedding happening this summer. Two billionaire families are merging, so it was only right to hire Rihanna to perform for $6.3 million and invite the likes of (style icon) Mark Zuckerberg and Bill Gates to attend (Source: Forbes).

718 is the average credit score in the U.S. Gen Z (~18-25) has the lowest average credit score at 680, and the Silent Generation (77+) has the highest at 760 (Source: Business Insider).

DEEP DISH 🍕

Elevating your credit score for financial success

In today's financial landscape, understanding and maintaining a good credit score is more crucial than ever. It's the golden ticket that can open doors to numerous financial advantages, potentially saving you a significant amount of money and making life's big purchases much more manageable. Let's explore why a good credit score is your financial best friend and how you can take steps to improve it.

The benefits of a stellar credit score

First off, a stellar credit score can lead to substantial savings and benefits. Imagine shaving tens of thousands off your home mortgage or cutting down the cost of your car loan by thousands. It doesn't stop there; lower interest rates on credit cards, loans, and even lower car insurance premiums are within reach. Setting up essential services like cell phone and utility contracts becomes a breeze without the need for hefty security deposits. Plus, securing a rental becomes simpler with landlords more likely to approve your application. The perks are undeniable.

Getting to know your credit score

Knowing your credit score is the first step. You're entitled to a free credit report each year from the three main credit agencies: Equifax, Experian, and TransUnion. Head over to AnnualCreditReport.com, fill out a simple form, answer some security questions to confirm your identity, and voila! You'll have access to your credit report. This is also your opportunity to dispute any errors and clean up your report.

Understanding credit score calculation

Understanding how your credit score is calculated is key to improving it. Your payment history, making up 35% of your score, highlights the importance of paying bills on time. Credit utilization, which should ideally be below 30%, influences 30% of your score and reflects how much credit you're using compared to what's available to you. The length of your credit history and the mix of credit accounts each play their roles, affecting 15% and 10% of your score, respectively. And lastly, the number of hard inquiries on your report—those instances when lenders check your credit—accounts for the remaining 10%. Managing these factors wisely can significantly impact your credit score.

Simple steps to improve your credit rating

Boosting your credit score might seem like a daunting task, but honestly, it's all about smart, simple steps. We've all heard the perks of having a high credit score, right? FICO breaks it down into five main categories: from Poor, which is between 300 and 580, all the way up to Excellent, which is between 800 and 850. Basically, if you can hit a score of 725 or above, you're in the sweet spot—Very Good. This means you get the best interest rates and financing deals out there.So, how do you get there?

1. Pay your bills on time. It might sound obvious, but it's a game-changer for your credit score.

2. Keep your credit utilization under 30%. It shows you're not maxing out your cards, which looks good to lenders.

3. Establish credit at your earliest opportunity. Remember, having a credit card too early without knowing the consequences of delinquent payments can destroy your credit.

4. Minimize hard inquiries. Lots of inquiries in a short amount of time can negatively impact your credit score.

5. Dispute any mistakes on your credit report. Those errors can drag your score down, so cleaning them up can give your score a boost.

In essence, a good credit score is more than just a number; it's a reflection of your financial health and a tool that can significantly impact your financial future. By understanding and managing your credit wisely, you're not just saving money; you're paving the way for financial success and stability.

SWEET LINKS 🍰

Digital bites we think you’ll like

Food for thought — Check out these 17 thoughts on money from a wealth manager.

What goes into your FICO? — Check out this video that explains what goes into your FICO score.

How does Warren Buffet invest? — Warren was formally the richest person in the world and still holds one of the top spots after donating a lot of his wealth. At 93 years old, he is still offering advice to the next generation of investors.