- Money Menu

- Posts

- Menu #22: The hidden dangers of a home equity line of credit

Menu #22: The hidden dangers of a home equity line of credit

PLUS: Digital bites we think you’ll like

Read Time = 5 mins

Good Morning, Money Menu readers! A warm welcome to new subscribers this week. Think of us as your new PFF (personal finance friends) 🤝

On last week’s menu, here’s what you missed in the previous menu.

On today’s menu, we’re discussing navigating big expenses.

On next week’s menu, we’ll deep dive into different types of investment vehicles.

STATS STACK 🥞

$69,519 was the average HELOC limit by Q2 2023, reflecting a steady upward trend driven by rising home values and increased bank credit offerings. This represents a 2.48% increase from the end of 2022, where the limit was $67,835. Since Q1 2018, when the average limit was $59,645, the HELOC limits have consistently risen, marking a 16.54% overall increase over the five-year period (Source: Money Geek).

70% of Americans viewed inflation as a “very big” problem in 2022, but this number decreased to 62% in 2023, indicating a shift in concern. Despite this decrease, inflation and the affordability of health care remain the top issues, with 60% of Americans considering health care costs a very big problem. Other significant concerns include partisan cooperation (57%), drug addiction (55%), and gun violence (53%), while issues like illegal immigration, climate change, and racism are rated lower on the list. (Source: Pew Research).

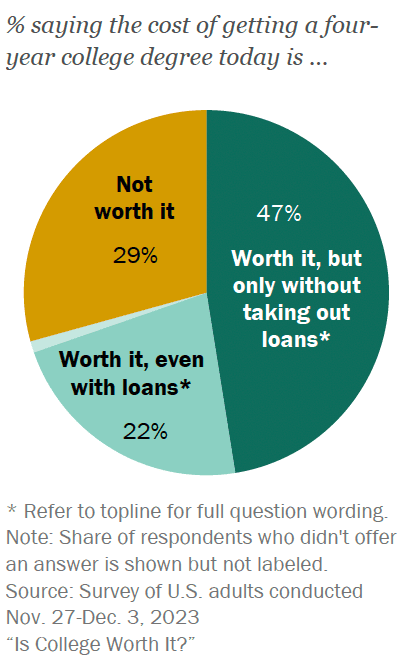

22% of Americans believe that the cost of obtaining a four-year college degree is worth it even if it requires taking out loans. Despite increased earnings and wealth among young workers without a bachelor's degree over the past decade, and similar improvements for young college graduates, the earnings gap between those with and without a degree remains unchanged (Source: Pew Research).

DEEP DISH 🍕

The hidden dangers of a HELOC

Facing a significant expense without sufficient savings can be daunting. A home equity line of credit (HELOC) might seem like a tempting solution, offering the illusion of easy access to funds. However, diving into the details reveals that a HELOC can be a precarious financial move.

Understanding Home Equity Lines of Credit (HELOC)

A HELOC allows homeowners to borrow against their home's equity, operating similarly to a credit card with a set credit limit. While it provides flexibility in borrowing and repaying funds, this convenience comes with considerable risks, primarily because it turns your home equity into collateral. This means failure to repay the HELOC could jeopardize your home.

The pitfalls of HELOCs

1. Risk to your home: Using your home as collateral means that in the event of non-payment, you could lose your house. This risk transforms a HELOC from a simple line of credit into a gamble with your family's security.

2. The illusion of cash flow: Although it might seem like a HELOC offers a solution to cash flow issues, it's essentially just another form of debt. Borrowing against your home to cover expenses or consolidate debt only shifts the financial burden, adding interest into the mix.

3. The long-term cost: With variable interest rates common to HELOCs, you may end up paying far more in interest than anticipated. Plus, the potential for fees and the requirement to pay back the borrowed amount can turn what seemed like a financial lifeline into a long-term liability.

Alternatives to consider

1. Build an emergency fund: Prioritizing an emergency savings fund can provide a buffer for unexpected expenses, reducing the need to borrow.

2. Save and pay cash: For planned expenses, like home renovations, saving ahead and paying with cash is the most financially sound strategy. It might take longer, but it frees you from the added burden of interest and debt.

3. Seek professional guidance: Consulting with a financial advisor can offer personalized strategies for managing expenses and improving your financial health without resorting to risky options like HELOCs.

Conclusion: Choosing stability over quick fixes

While a HELOC might offer an immediate solution to financial shortfalls, the long-term implications can undermine your financial stability and peace. By adopting a disciplined approach to budgeting, saving, and investing, you can navigate life's financial challenges without sacrificing your home or future well-being. The path to financial freedom lies in making informed, prudent financial decisions that bolster your security and prosperity.

SWEET LINKS 🍰

Digital bites we think you’ll like

Do your taxes for free — The Treasury Department recently announced that the IRS' Direct File program, a free online tax filing service, will be made permanent starting with the 2025 tax season. This is great news for Americans who won't have to pay to file their taxes anymore, potentially hurting private services like TurboTax. The pilot program saw over 140,000 participants across a dozen states, claiming over $90 million in refunds, surpassing its target of 100,000 users.

Calculate your family budget — The EPI's Family Budget Calculator reveals what it really takes to live comfortably in any U.S. community. It goes beyond the outdated federal poverty line to offer a true picture of economic security. The 2024 update uses the freshest data to ensure accuracy, covering every county and metro area nationwide. Discover how much income you need for a decent living with EPI’s comprehensive tool!

Hold off on HELOCs — This video highlights some of the cons of HELOCs, including failure to repay, losing your property, or overborrowing. The easy access to funds might tempt you to make unnecessary purchases, increasing your financial strain.